How to open a Paypal account to receive money was never a topic until the banned came either from the Nigerian government or from the Paypal company.

The reason why I’m not certain where the ban came from, is because, I did some research via google, and I never saw an article published with a statement from Paypal or the Nigerian government on why Paypal was banned and what year the banned became effective.

But according to Mfonobong Nseh, a former content contributor(writer) in Forbes, shared his painful story as to how Paypal decided to block his account because he tried accessing it from Nigeria, even though the account was originally opened in Switzerland where he schooled.

To cut the long story short, his Paypal account was blocked, and after providing everything that was asked from the Paypal team via email, he said his PayPal account was still not unblocked and they stopped communicating with him. To get the full story you can read his article: “Is PayPal Scared Of Nigeria?”

So I can conclude that Paypal was actually the brain behind the total ban of PayPay accounts in Nigeria.

Their decision on blocking PayPal accounts in Nigeria came as a result of their Anti-money Laundering policies

But in 2014 after a petition was made on Change.org to let Nigerians receive funds with PayPal, the banned was eased on Nigerians.

But with a major limitation of sending money only. This didn’t sit well with Nigerians as they felt it is of no use.

But in March 2021, Flutterwave announced; Flutterwave’s partnership with Paypal to help receive payment.

But this still didn’t help as it was discovered that Nigeria was not still among the favored country in the partnership even though, Flutterwave is owned by a Nigerian and started from Nigeria.

But if you were to integrate a Paypal checkout on your Flutterwave store, it will work 100% fine. This Video by a Youtuber called Fisayo Fosudo explains how you can link a Paypal checkout to your Flutterwave store;

In July 2021, EFCC had to come into the ban situation to get it lifted through their influence as a security department against cybercrime in Nigeria, but it was to no avail. You can access the whole story from TheStreetJournal.

But the Good News I will be sharing in this article is that, since last year after the partnership between Paypal and Flutterwave, there has been a way around which you can use Paypal in Nigeria to receive money directly into your Paypal wallet without going through Flutterwave.

Going through Flutterwave will mean you have to share a 4.4% fee on your transaction value.

Now let’s check out the easy-to-understand steps on how to set up a PayPal to receive money in Nigeria

Table of Contents

1. Open the Paypal website.

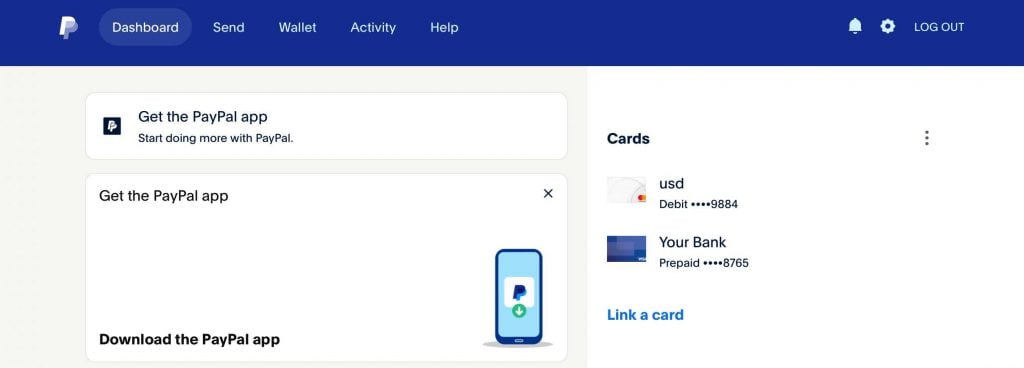

Now, you must be very careful here, because if you open the original Nigeria Paypal website and register there, your account will look like this picture below 👇

If you carefully look at the above picture you only notice the icon “send” and no receive icon in sight. which indicates that this kind of PayPal account can’t receive but can only send.

So, to open a Paypal account that can both send and receive money in Nigeria you will need to go to Paypay.com/is

The “IS” included after “/” is what makes the difference. If you go to Paypal.com without the “/IS”, It will automatically take you to Paypal.com/ng.

And if you open a PayPal account with paypal.com/ng you will end up having an account that doesn’t receive but only sends money. Just like the illustrated picture above.

In summary in step one;

Paypay.com/is ✅✅✅ Open a PayPal account via this link

Paypal.com/ng ❌❌❌ Don’t open a PayPal account via this link

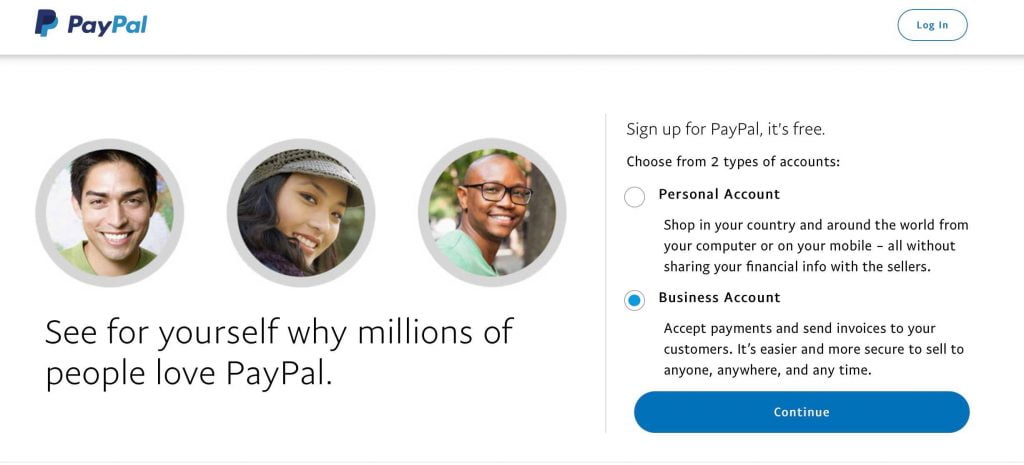

2. Click on Sign up and choose Business Account.

When you click on Sign up, you will be given two options;

1. Personal account: This one has the ban option on receiving money if you include Nigeria as your country, which is compulsory.

If you want to play cunning by choosing another country, you will get yourself and your account permanently or temporarily blocked because your IP will “rat you out”.

So make sure you put in the right information.

2. Business Account: The PayPal business account is where you will click and that’s where I will continue the process of opening a Paypal account.

3. Fill in all the Information Provided

Now you start filling in all your information as the prompts come up.

Because it is a business account you are opening, the question that will be asked won’t be totally related to individual questions

But you can use your personal information like address, email, and phone number.

Before I skip this important information; when you are being asked what type of business, choose the “Sole proprietor”. -Because a sole proprietor is more like an individual account.

When answering the questions according to each prompt, you must take note of these two important questions;

- The country of Residence: If you find one in any of the prompts, choose Nigeria first before attending to other questions in that particular prompt. The reason you do that, is so that, the question will be rearranged to questions pertaining to Nigerians. -That is because, it is paypal.com/is, meaning it is originally a Paypal website in another country.

- Zip Code: When you see the option Zip Code, leave it blank as it is not for Nigerians.

I know you asking; “why am I not dropping photos again for pictorial explanations”? My answer is; the interface is very easy to navigate❗️

But if you are faced with any challenges you can drop them in the comment section.

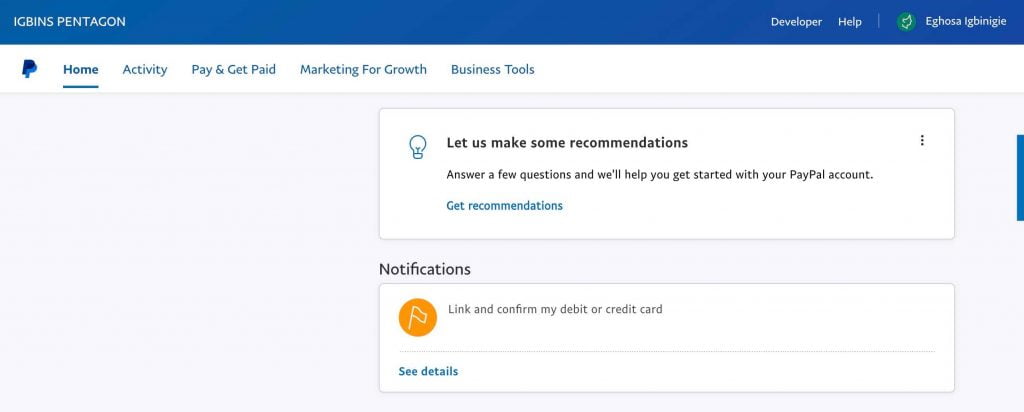

When you are done, the home page of your newly opened account will look like this.

3. Verify your Paypal Business account

To verify your Paypal Business account in Nigeria, you have to complete these two steps

- Confirm your email

- Link your Card.

Linking your card is very important because that is what you will be using to move money in and out of your Business PayPal account.

But the only condition when linking your card to your Paypal Business account is; “it must be a domiciliary bank account card“. -This one is not PayPal’s fault but the Central Bank of Nigeria’s (CBN) Fault

“According to the directive from Banks, as of 31 December, no Naira card will work for international Transactions. And that has been effective for everyone who has tried it including me.”

Opening a domiciliary bank account from any Nigerian bank is very easy and fast, but there is a fee of about $9 to get the card.

If you feel that will be too much you can use Chipper Cash App; “Open an account and get a dollar Card that you can easily connect with your PayPal Business account.

They sell and buy with the black market foreign exchange rate and they have a very strong security system.

The reason I recommend Chipper is because I use them. Here is my Chipper Cash Referal.

One unique advantage of using a domiciliary account card on your Paypal is; You can move the money from your Paypal account to your domiciliary account and do a physical withdrawal over the bank counter.

There is also another option of linking your bank account. Please don’t try linking your Nigeria bank account, as the option is meant only for a US bank account.

And if you happen to have a US bank account through whatever means it came by, still don’t link it. If you do, your account might be flagged for suspicious activities because your IP is reading Nigeria.

And from the Mfonobong Nseh PayPal story on Forbes, when your account is flagged it might never be recovered again.

Challenges Associated with Opening a PayPal Account in Nigeria:

Here are the challenges associated with opening a PayPal account in Nigeria:

- Restrictions on Sending and Receiving Money: Historically, Nigerian PayPal accounts have had limitations on sending and receiving money. This restriction has affected the ability of users to engage in certain online transactions.

- Verification Issues: Nigerian users encounter challenges with account verification. This includes challenges in linking a Nigerian bank account or credit/debit card to the PayPal account for full functionality.

- Limited Services: Some PayPal services and features are limited or unavailable for Nigerian accounts. This could include restrictions on withdrawing funds to local bank accounts.

- Geographical Restrictions: PayPal has, in the past, placed restrictions on certain countries due to regulatory and compliance reasons. Nigeria has faced challenges in this regard, leading to limitations on the use of PayPal services.

- Currency Conversion Issues: Users are likely to experience difficulties with currency conversion, as PayPal does not fully support the Nigerian Naira. This results in additional fees or difficulties in making transactions in the local currency.

- Government Regulations: Regulatory factors and government policies impact the availability and functionality of PayPal services in Nigeria. Changes in regulations affect the ease with which individuals and businesses can use PayPal for transactions.

Conclusion

That is all about how to open a PayPal account to receive money in Nigeria which can be achieved through a PayPal business account in Nigeria.

I hope this article was beneficial to you.

If you have a question or Contribution, leave it in the comment section.

Remember to turn on the Bell notification as more business-related articles drop soon.

Here is a video explanation by Nick Finance Naija, on the step by step of opening a PayPal account that can receive money in Nigeria.

Read Also:

- Top 5 Money-making Apps that pay you in Dollars and In Crypto Currencies

- 9 Juicy ways to make money online in Nigeria for free

- How to pay off Debt Fast: 5 things you should never do with a Loan money

FAQs

Do I need to link a bank account to PayPal to receive money?

No, you don’t need to link your bank account to Paypay to receive money if you are in Nigeria. By linking just your card to your Paypal, you can both withdraw and deposit on your Paypal account.

Which bank uses PayPal in Nigeria?

All banks use Paypal in Nigeria, as long as it is connected only to the domiciliary account and not to the Naira account. This is due to the ban enacted on the 31st of December 2023.

Do you need a bank account to open a PayPal account?

No, you don’t need a bank account to open a Paypal account in Nigeria. All that is required is that you provide all the information required and a means of Identification.

Does Kuda accept PayPal?

No, Kuda does not accept Paypal. The reason is that Kuda only operates on local transactions and with the ban from CBN on Naira cards, Kuda no longer accepts international transactions. So, it is not possible for Kuda to accept any transaction from Paypal nor send money to and through Paypal.

What is the best PayPal to use in Nigeria?

The best Paypal to use in Nigeria is the “Business PayPal Account” because, it offers you more options that include receiving and sending money, creating invoices, and Paypal checkout

Which card is accepted by PayPal?

Only domiciliary account cards are accepted by Paypal because of the banned currently on Naira cards by the CBN in Nigeria.

How long does it take to receive money on PayPal?

The time it takes to receive money on Paypal depends on the means by which the money was sent.

If the transfer of funds is from another PayPal account, it appears immediately following the finalization of payment by the sender.

The same goes with a credit card or debit card, except the payment is suspicious and under reviewal measures, that is when it might take a couple of days

And finally, should the payment be transmitted via an eCheck, it can take a few days to reflect.

Hi My name is wisdom , how do you transfer money from Paypal to another bank or online bank, is it even Possible?

Some said the only way to redraw money from Paypal is to link Paypal to Uba bank why some say it’s true flutter wave today some one told me that is only possible to redraw in naira if I can transfer the money to another bank or online bank like opay ,palmpay I’m confused and I need suggestions please

You can only withdraw from Paypal when you follow through with the process outline in the article to open a standard Paypal account.

But instead of paying the money to your Paypal, while not pay it to a Payoneer account or send it directly to an online banking platform that receives USD such as Chipper Cash.

I created a PayPal business account, which is the best to link ? My business domiciliary account or my individual domiciliary account ?

If the paypal was opened with your business name, link your business account, like wise for individual name registration.